THE NEXT

PHASE OF

AI

A Cognitive and

Connected Enterprise

December 2019

THE NEXT

PHASE OF

AI

A Cognitive and

Connected

Enterprise

December 2019

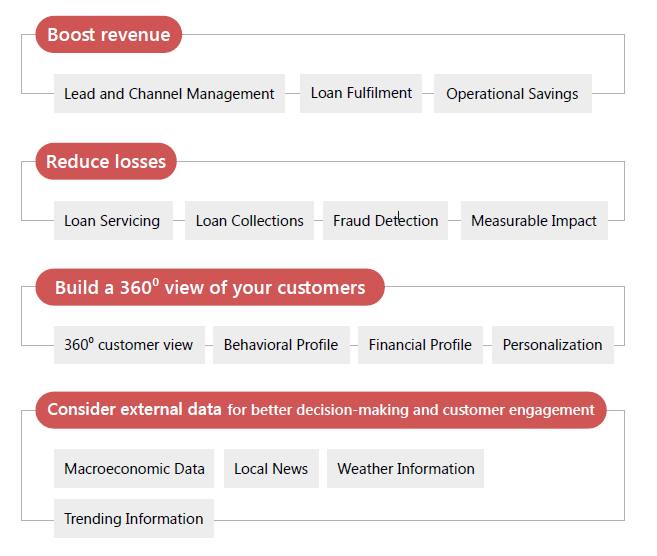

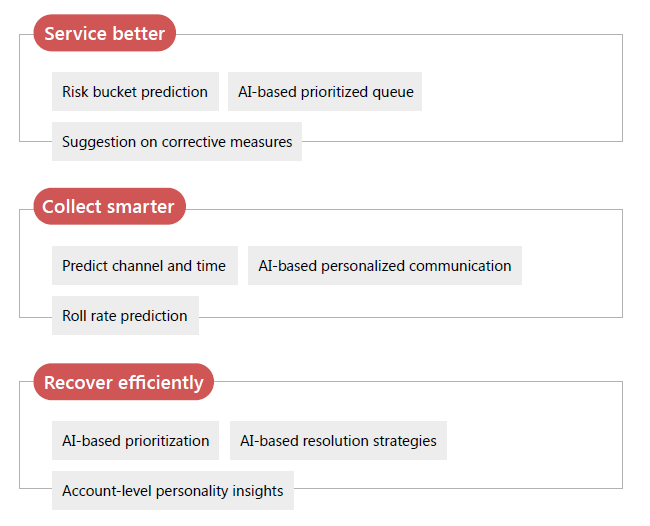

The FinXEdge suite of business apps for lending will be able to leverage AI to:

If you work in a financial institution, you’re not alone in having these questions. Change in customer behavior and high expectations means Financial Institutions need to raise the bar with innovative business models in the battle to win the customer – understanding and enhancing user experience. In a highly regulated industry, it can be challenging to be as agile as your customer and, if you aren’t, the consequences are significant. Everyone is talking fintech, but no one seems to know exactly where to start. And you have your challenges with adding intelligence to your business – silos, a lack of data expertise and infrastructure, and the absence of AI explainability which gets in the way of governance and regulatory requirements. While each of these issues is valid, can you put off the evolution of your business until you fix these issues? Let’s answer that!

By Praveen Kombial

VP, Global Product Head,

Business Applications,

EdgeVerve Systems Ltd. (An Infosys Company)

Life isn’t linear. This line may sound like a truism, and it is, but there’s more. Digital technology has converted what began as the consumerization of IT, the influence of the consumer on business thinking, into the consumerization of industry. What we’re saying is that the consumer’s life is complicated, non-linear, and dynamic. To be successful, organizations now need to behave, think, and interact with their consumers just like other consumers would, but even better. The successful enterprise is characterized by its ability to provide contextual, personalized, and meaningful customer interactions, all while delivering exceptional experiences.

Businesses can no longer rely on a transactional approach, but need to think with intelligence and agility – cognitive capabilities that can be driven in the enterprise by machine learning and AI.

Cognitive enterprise solutions are starting to change how organizations work by allowing them to proactively meet customer expectations, even before the customer is aware of them.

At EdgeVerve, we draw on our experience of using technology to turn business challenges into opportunities for innovation, customer excellence, and growth to build fit-for-purpose intelligent applications. We understand that financial institutions need a fast way to get intelligent without overhauling their existing infrastructure.

AI adoption is the key to transforming customer experiences at scale in a digital economy. That’s why we built FinXEdge, a layer of intelligence that transforms your financial institution into a cognitive, connected enterprise. FinXEdge is “Applied AI” that helps users to move from experimentation to production. FinXEdge is a suite of pre-built enterprise AI apps that helps clients see results faster and deliver real value to the business and deploy innovative solutions that solve real-world industry-specific problems.

With the FinXEdge suite, you can supercharge your customer experience at scale to ensure that you get the most out of your digital ecosystem. The platform enables you to use AI for customer acquisition, matching customers to the right loans, and also reducing losses through dynamic default and fraud management. Most importantly, you can now create a 360⁰ view of your customer and provide a contextual and hyper-personalized service.

In a system with several customers, each using many different services, it is difficult to resolve customer challenges and demands without a comprehensive understanding of their behavior. Furthermore, consumers are affected by factors beyond your business data, such as macro-economic trends, weather, and other events taking place in the broader world. By deriving intelligence from a range of internal and external sources, through both structured and unstructured data, FinXEdge deploys powerful AI to make your service not just relevant, but coherent.

Through a wide range of applications, FinXEdge can help your banking, lending and collection efforts by allowing you to acquire and retain customers, increase your loan conversion rate, reduce time to decision, reduce charge-offs, and minimize losses from delinquency.

The benefits of this intelligent approach are not restricted to your customers alone but have a significant impact on employee satisfaction and productivity. It is here that FinXEdge really comes into its own. The application sits on top of existing core servicing, collection, and other systems, adding a layer of intelligence for actionable insights.

Additionally, as opposed to black-box AI, FinXEdge’s explainable AI offers users a thorough understanding of every decision from the metrics chosen and the behavior considered to the logic applied. This transparency ensures that your banking operation gains intelligence and efficiency in line with governance, compliance, and regulatory requirements.

The imperative to transform is no longer a question of competitive advantage, but one of building a roadmap for the future to stay relevant!

By Praveen Kombial

VP, Global Product Head,

Business Applications,

EdgeVerve Systems Ltd. (An Infosys Company)