Customer experience will drive growth in new age banking

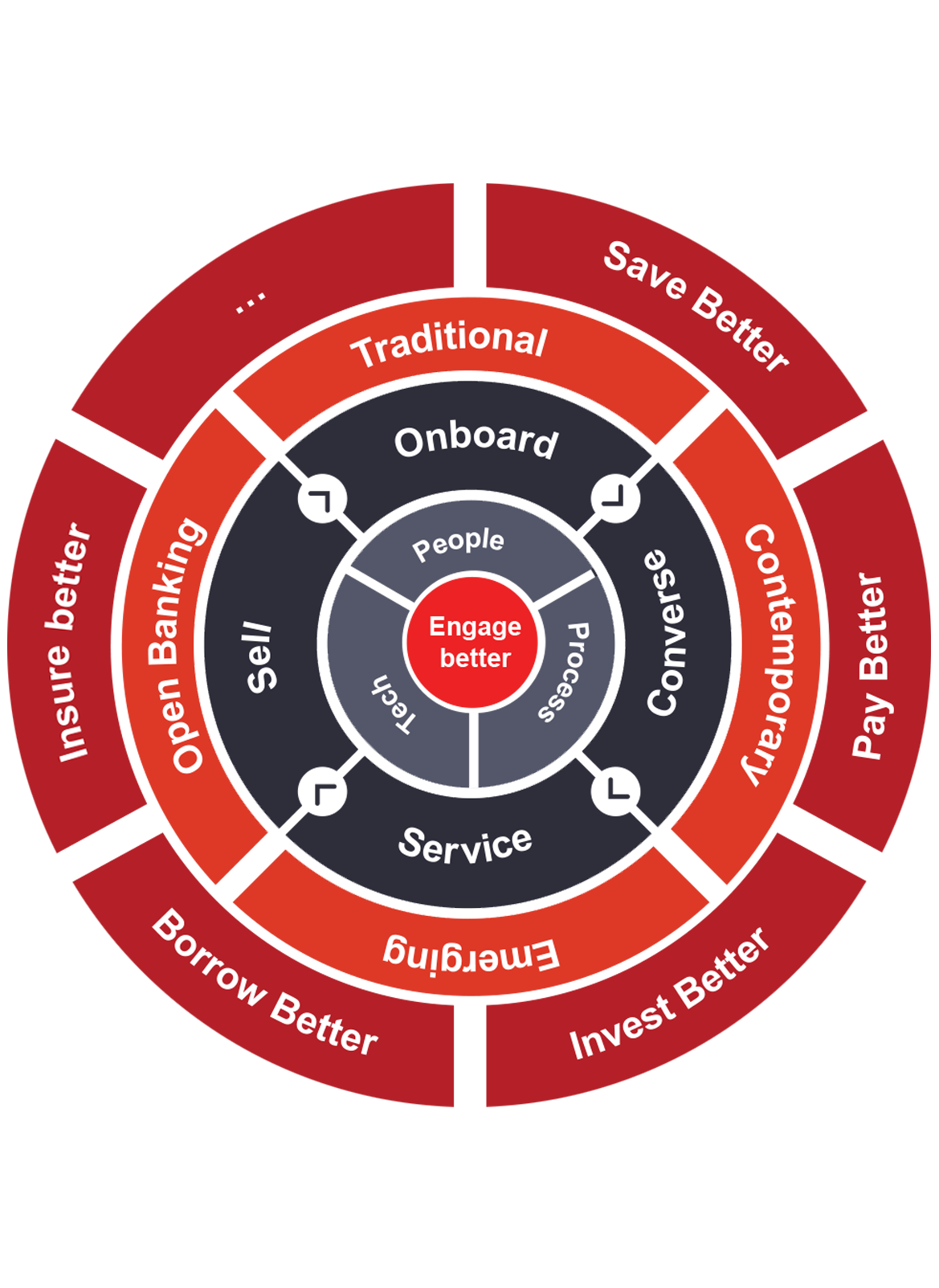

A holistic approach to driving superior engagements will include aligning people, process, and technology to drive customer-centric engagements across a broad range of traditional, contemporary, and emerging channels.

When done right, each interaction will improve the financial well-being of the customer by empowering them to save, borrow, pay, insure and invest better.