Better Banking Operations - It's time for holistic approach

At the intersection of multiple forces, banking operations today require a new multi-dimensional approach for better outcomes

It is proven that digitization can help banks achieve much-needed operational improvement and accrue – according to one estimate – 30 to 50 percent saving in costs. A master framework for better operations should take both the customers’ perspective and internal operations requirements. Finacle identifies 5 transformation pillars for reimagining banking operations.

Business strategy and alignments, with focus on business models, target customer segments, products and services portfolio and channels mix

Smart processes, and newer ways of working that are customer-centric, digital-friendly and open to automated execution

Workforce modernization for skilling the people managing operations, enabling them with platforms to nurture a culture of continuous learnability

Structural IT transformation, with a focus on digital-first platforms, continuous transformation programs and cloud-based innovative models

Strategic governance to ensure that the technology, people and processes driving better operations are measurable, risk contained and compliant

Driving Better Operations

with Strategic Alignments

Finacle’s flexible platform enables banks to achieve strategic alignment across business model, customer segments, product offerings and channels:

Be it a pipeline business model or a platform business relying on a vast ecosystem of partners, banks of any type and at any stage of their journey can rely on Finacle to meet the varied needs.

A suite of digital product engines, along with Finacle App Centre brings a wide range of products and solutions, enabling banks achieve transformation of product portfolios.

Offers a contemporary digital engagement suite - an advanced omnichannel solution for a broad range of traditional, modern and emerging channel experiences to all users.

Liv. By Emirates NBD enjoy cost to income ratio of less than 20%, with overall group at renarkable 32%

Read Case Study

Powering Better Operations

with Smart Processes

Finacle offers robust digital capabilities to enable banks build modern business processes:

Comprehensive digital engagement capabilities to deliver customer centric journeys in key business processes across on-boarding, conversations, servicing and selling.

Digital-only constructs to enable customer first, APIs and ecosystem first, insights first, automation first and cloud first propositions, powering modern digital processes.

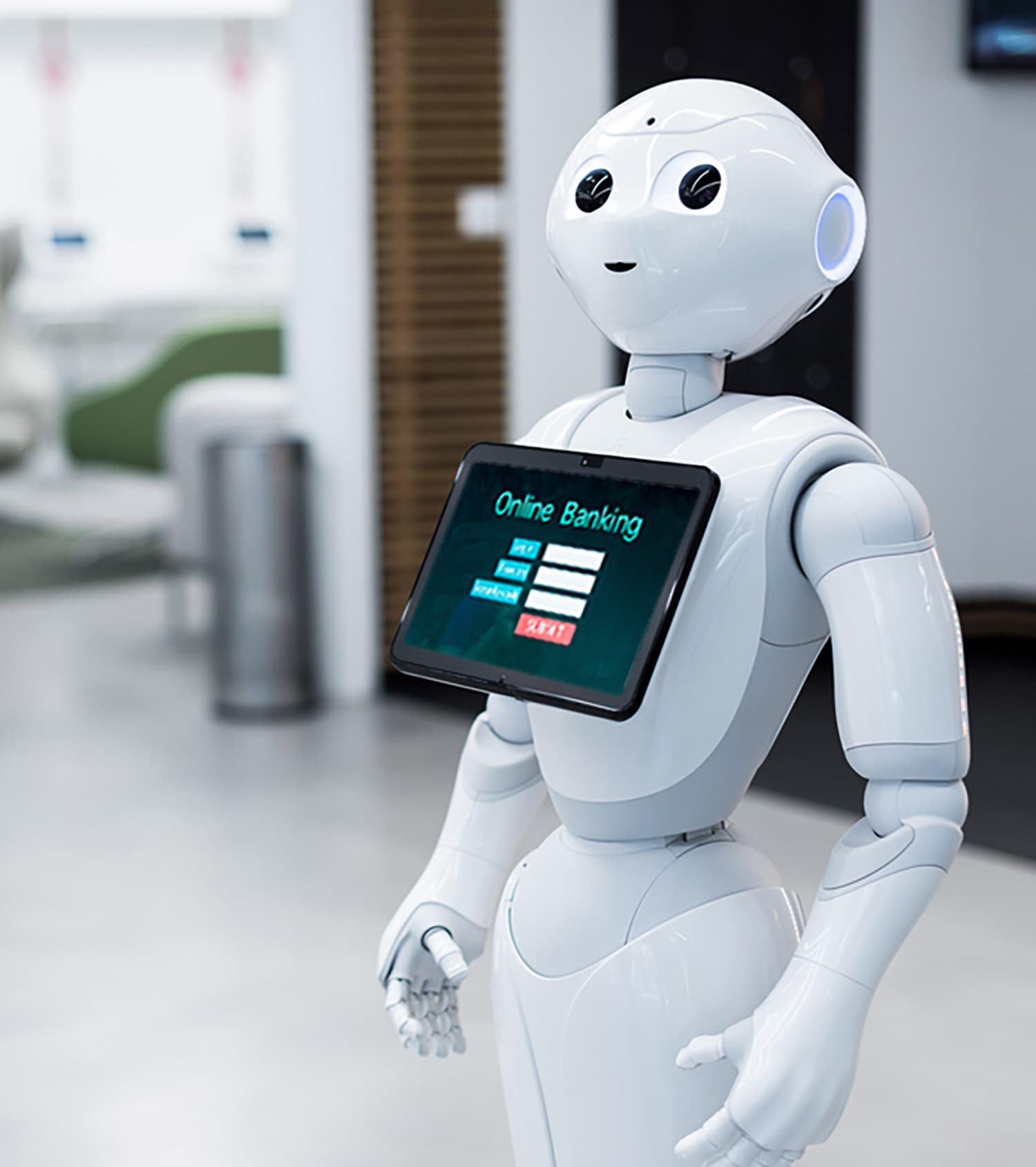

A host of automation enablers including traditional automation levers, robotic process automation, blockchain powered inter organization automation and industry utilities to drive new efficiencies.

Augmented Workforce

for Better Operations

With continuous learning & re-skilling, tech adoption and co-innovation as the guiding principles, Finacle offers a host of enablers:

Wingspan – the cloud first, mobile first next-generation learning platform from Infosys, to help organizations accelerate their talent transformation journey

Delivers blended workforce propositions with RPA bot factory, embedded insights and a broad suite of use cases to allow seamless transition between machines and humans

Offers multiple co-innovation platforms including Finacle Client Advisory Board, FinTech Connect Council, Banking Visionaries Council, Joint hackathons , and client and partner specific programs

RPA at Nations Trust Bank delivered as high as 90% reduction in operational costs for select processes.

Read Case Study

Driving Better Operations

with Technology Advantage

Powered by technology architecture virtues, Finacle offers a host of enablers to make operations open, scalable, real-time and cost-effective

Brings to the fore several digital-first enablers, such as composable solution design, expansive suite of RESTful APIs, and data models that drive customer centricity

Supports continuous modernization with its componentized solution suite, agile implementation approach, and integrated DevSecOps

Built leveraging cloud native computing foundation (CNCF) standards, and the twelve-factor app methodology, offers cloud-native, cloud-agnostic digital banking suite to drive flexibility and meet every bank’s unique requirements

Having implemented Finacle Digital Banking Solution Suite on SaaS model, Australian Military Bank has seen a decrease in the operating costs by 3% to 4%, while those of peers have been increasing by 5% to 7%

Read Case Study

Strategic Governance

Making Banking Operations Resilient

Finacle offers expansive product native capabilities as well as enterprise class offerings to enable banks manage all types of risks, and comply with evolving regulatory landscape. Key offerings include:

Enterprise-wide risk management enablers such as limits, collaterals, and covenants management offering for centralized, global exposure management

Actionable customer and business insights through Finacle Insights - an unified, banking–specific, data and analytics solution; offers pre-integration with Finacle digital product engines for accelerated insights

The global regulatory and compliance practice, that continuously enables product architecture’s localization layer readiness for evolving regulatory landscape, supporting varied regional requirements.

Leveraging Finacle advanced analytics capabilities, Sohar International now captures deeper consumer insight, which in turn helped the bank become extremely customer-centric. The bank has seen over 67% reduction in human resource utilization across effected processes.

Read Case Study